How to Ensure the Inflation Reduction Act Supports Domestic Production

A year after becoming law, President Joe Biden’s Inflation Reduction Act (IRA) is mired in uncertainty. Stakeholders question its potential to achieve its core goals of supporting domestic manufacturing, speeding clean energy development, and reducing U.S. dependence on China.

The law provides billions of dollars in tax credits and incentives to bolster clean energy manufacturing in the U.S. and challenge China’s dominance in the sector. And with $349 billion invested in U.S. clean energy since it became law, the IRA seems to be off to a good start.

Yet there are concerns among American businesses that fear the IRA could repeat the mistakes of the 2009 American Recovery and Reinvestment Act (ARRA), which also offered large tax incentives for domestic solar manufacturing. China responded to the ARRA by flooding the U.S. solar market with artificially low-priced panels and equipment, propped up by massive government subsidies. Despite the ARRA’s best intentions, many believe it contributed to the decimation of the U.S. solar industry by 2012.

Supporters of the IRA say lessons have been learned. On top of the law’s 30% tax credit for renewable energy facilities such as solar and wind farms, organizations can receive a bonus for using domestically manufactured components in their projects, worth 10% of total project costs. To qualify for the bonus, all iron or steel products used in clean energy assemblies must be “melted and poured” in the U.S., and 40% of solar assembly components must be made domestically.

Meanwhile, IRA critics point to recent clarifications from the U.S. Treasury Department, which say that solar energy assemblies can still qualify for tax breaks as “American-made” products even if the assembly contains solar cells that are made with Chinese materials.

So what does the future hold for the IRA? Here’s what Barry Zekelman, Chairman and CEO, Zekelman Industries, has to say about the IRA’s potential impact on U.S. solar manufacturing, American steel, and foreign competition.

Q: How will the IRA’s tax credits for foreign solar companies impact American steel manufacturers? Does it create an uneven playing field?

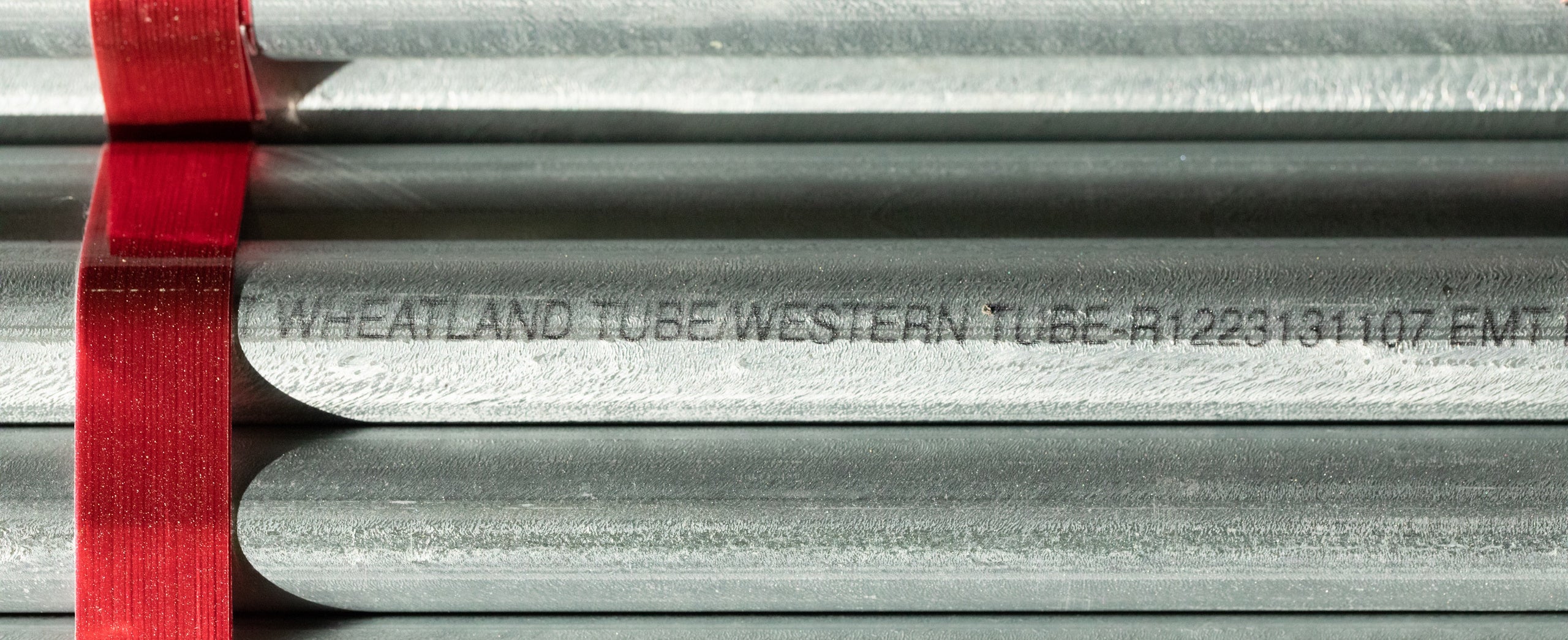

Zekelman: Steel is going to be a big part of solar. We believe that by 2026 or 2027, there will be up to 3 million tons of steel going into the solar industry every year, so it is vital that the IRA supports U.S. steel manufacturing.

We need to make sure the IRA’s incentives support domestic production instead of foreign-made products. If that happens, it will have a positive impact on American steel and U.S. manufacturing.

Where the playing field gets uneven is that there aren’t enough U.S. solar panel manufacturers to supply the panels for those assemblies after the U.S. solar industry was decimated by China. So the IRA contains a waiver that allows companies to buy solar panels from China for two years.

Q: How can trade policy help ensure the IRA incentives benefit U.S. steel companies rather than undercut them?

Zekelman: We must make sure that foreign-made components going into solar assemblies are not eligible for tax credits. If foreign components receive tax breaks, they will continue to be made outside of the U.S. IRA incentives are tied to the components contained in the solar assembly, so there shouldn’t be loopholes that benefit foreign-made components.

Making an assembly is like making a cake: There are a lot of ingredients that go into the final product, and we want to make sure that there are taxes on all foreign ingredients. Either you use domestic ingredients, or you don’t get the tax credit. We estimate there could be over 1 million tons of torque tube steel going into solar. We want to make sure it is all being made here.

Q: What specific steps would you like to see U.S. policymakers take regarding steel and the IRA?

Zekelman: I’d like to see some of the steps established in the IRA applied elsewhere. There are regulations and incentives that say federally funded projects need to be made of U.S. made and melted steel, or they must contain a certain percentage [of] U.S. steel. Let’s make it simpler: If the government is using taxpayer dollars to do something, the taxpayers — American manufacturers, American workers, American consumers — should benefit from it. Tax dollars should only be spent on goods produced here in North America if they are available here. If we don’t make the products, they will have to be bought elsewhere, but the priority for policies like the IRA should be to bring the manufacturing of those products back to the U.S.

Q: How does supporting U.S. steel manufacturers through the IRA help American consumers and the overall economy?

Zekelman: Supporting U.S. steel generates jobs and increases domestic investment, which in turn increases the tax base of communities. It creates opportunities in communities by generating more businesses — one manufacturing job creates five or six other jobs to support it. It creates a system that supports skilled jobs where people earn higher wages than minimum wage. They are jobs for life — and life-sustaining jobs. It’s a chain reaction: When jobs and investment come back into the system, it benefits entire communities, which benefits the USA.

Q: What is the most important thing U.S. manufacturers need consumers/voters to understand about the IRA’s impact right now?

Zekelman: If the IRA isn’t implemented properly, I don’t think our solar industry will be able to achieve the growth and capacity needed to become a strong domestic and global supplier. It needs a push. If the IRA doesn’t prioritize U.S.-manufactured products, more products will come from other countries and take away U.S. jobs.

If products are manufactured here, we can also ensure they are safe, clean, and made correctly by people who will be paid well. We’re not going to be able to improve our communities if all of the manufacturing jobs remain overseas.

There’s nothing better than building something you believe in.

Zekelman companies are in constant motion, expanding our teams and challenging convention.

"*" indicates required fields